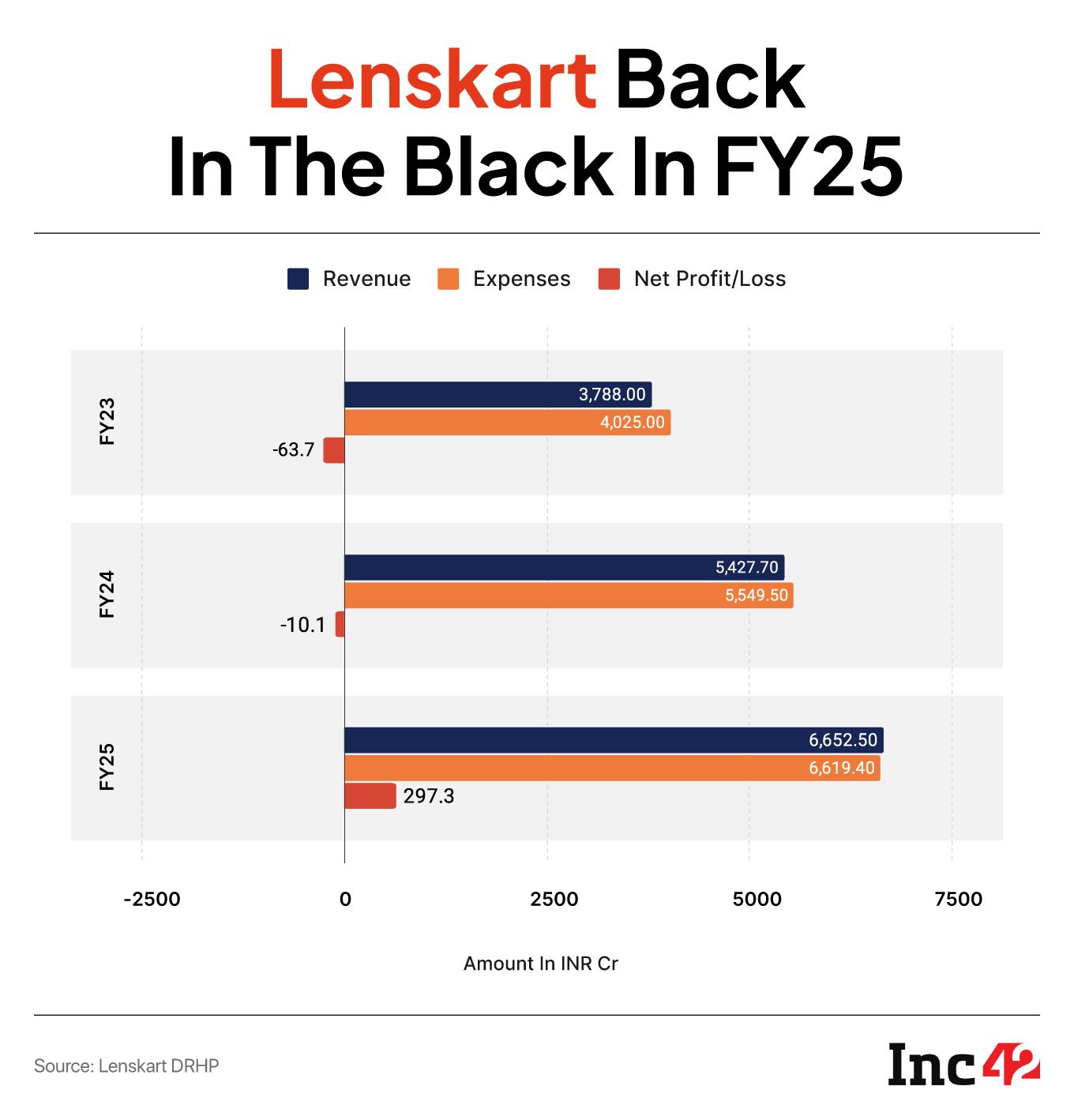

IPO-bound omnichannel eyewear retailer Lenskart turned profitable in the financial year ended March 2025 (FY25), posting a net profit of INR 297.3 Cr as against a net loss of INR 10.1 Cr in the same period last year.

The company managed to turn profitable on the back of improvement in margins. Lenskart’s operating revenue jumped 22.5% to INR 6,652.5 Cr during the year from INR 5,427.7 Cr in FY24, as per its DRHP.

The company’s IPO will comprise a fresh issue of shares worth up to INR 2,150 Cr and an OFS of up to 13.2 Cr by SoftBank, Kedaara Capital, cofounder Peyush Bansal, among others.

The company plans to use the proceeds from the fresh issue to expand its company-owned stores network, for tech upgrades, marketing, and infrastructure development.

Founded in 2008 by Bansal, Neha Bansal, Amit Chaudhary and Sumeet Kapahi, Lenskart designs, manufactures, and sells prescription eyeglasses, sunglasses, contact lenses, and related accessories. While India is the company’s primary market, it has also expanded into a number of other regions like Japan, Southeast Asia, and the Middle East.

It is pertinent to note that cofounder, CEO and MD Peyush Bansal bought shares worth INR 221.1 Cr from the company’s shareholders ahead of the eyewear giant filing its DRHP.

Prescription eyeglasses are the core of Lenskart’s business, accounting for over 80% of its operating revenue annually. These are primarily made-to-order and produced in the company’s facilities in Bhiwadi (Rajasthan) and Gurugram (Haryana). The two units together manufactured 1.3 Cr units in FY25, about 70% of global prescription eyewear sales. Additionally, Lenskart manufactures eyeglasses in select countries via contracted third-party partners.

The company offers sunglasses under brands like Vincent Chase, John Jacobs, Hustlr, and Owndays, while it sells contact lenses under the brands Aqualens and Owndays. It also sells accessories such as lens clothes, cases, and repair tools, which are sourced from third-party vendors.

Lenskart also provides services such as in-store and online eye tests, home trial offerings, post-sale repair services, and sale of gift cards.

Besides, the company runs loyalty programmes like Lenskart Gold, launched in India in 2018. It had 67.7 Lakh members as of March 2025. Owndays also has a points-based rewards programme. The company also earns revenue from membership fees.

Lenskart operates on an omnichannel distribution model, combining retail stores, mobile app, web platform, and home trials. As of March 31, 2025, the company operated 2,723 stores worldwide – 2,067 in India and 656 internationally – spanning 23.2 Lakh sq. ft. of retail space.

The store network includes company-owned and company-operated (CoCo) stores, franchisee-managed outlets, and mixed models. The company acquired Dealskart in December 2024, which led to addition of 1,606 stores to Lenskart’s network.

In India, Lenskart has 900 stores in metro cities, 469 in tier I cities, and 698 tier II cities. Besides, it operates 267 stores in Japan, 251 across Southeast Asia, 39 in the Middle East, and 99 in other regions like Taiwan, Hong Kong, and Australia.

Its online services are extended further to other regions such as North America and Europe via its logistics partners. Overall, Lenskart served 1.24 Cr customer accounts globally in FY25.

As per its sales data, it sold 2.72 Cr eyewear units in FY25, of which 2.29 Cr units were sold in India and 42.9 Lakh outside the country. In India, 75.82% of the company’s sales came from physical stores, 12.62% from Lenskart’s digital platforms, and 11.57% from third-party online channels. Internationally, 97.44% of bookings were made in stores.

In addition to direct sales, Lenskart also earns revenue from brand licensing.

Breaking Down Lenskart’s ExpensesThe company’s expenses for FY25 stood at INR 6,619.4 Cr, up 19.3% from INR 5,549.5 Cr in the previous fiscal year.

Employee Benefit Expenses: The company spent INR 1,378.7 Cr on employee expenses during the year under review, up 26.9% from INR 1,086.4 Cr in FY24.

Marketing & Promotion Expenses: Lenskart’s expenses under this head zoomed 37.5% to INR 484.4 Cr from INR 352.1 Cr in FY24.

Commissions & Incentives: The eyewear brand saw its expenses under the head decline by 3.7% to INR 733.1 Cr in FY25 from INR 761.4 Cr in the previous fiscal year.

The post IPO-Bound Lenskart In The Black, Posts INR 297 Cr Profit In FY25 appeared first on Inc42 Media.

You may also like

'Your conduct does not inspire confidence': SC reserves verdict on Justice Yashwant Varma's plea - What the top court said

Abhay Verma Rings in 27 with a Starry Birthday Bash in Mumbai

LunchBox by Rebel Foods Serves Up Shravan with a Side of Comfort – Launches Special Satvik Menu Across Platforms

Delhi Police tighten noose on drug peddlers under stringent PITNDPS Act

IndiQube Spaces Lists At Nearly 9% Discount Despite Strong IPO Subscription