“The quantifiable financial impact on the company cannot be ascertained at this point in time,” EPC firm Gensol said in an exchange filing yesterday on the impact of an interim order passed by SEBI.

This came a day after the markets regulator, in the interim order, , Anmol Singh Jaggi and Puneet Singh Jaggi. The Jaggi brothers are also the cofounders of .

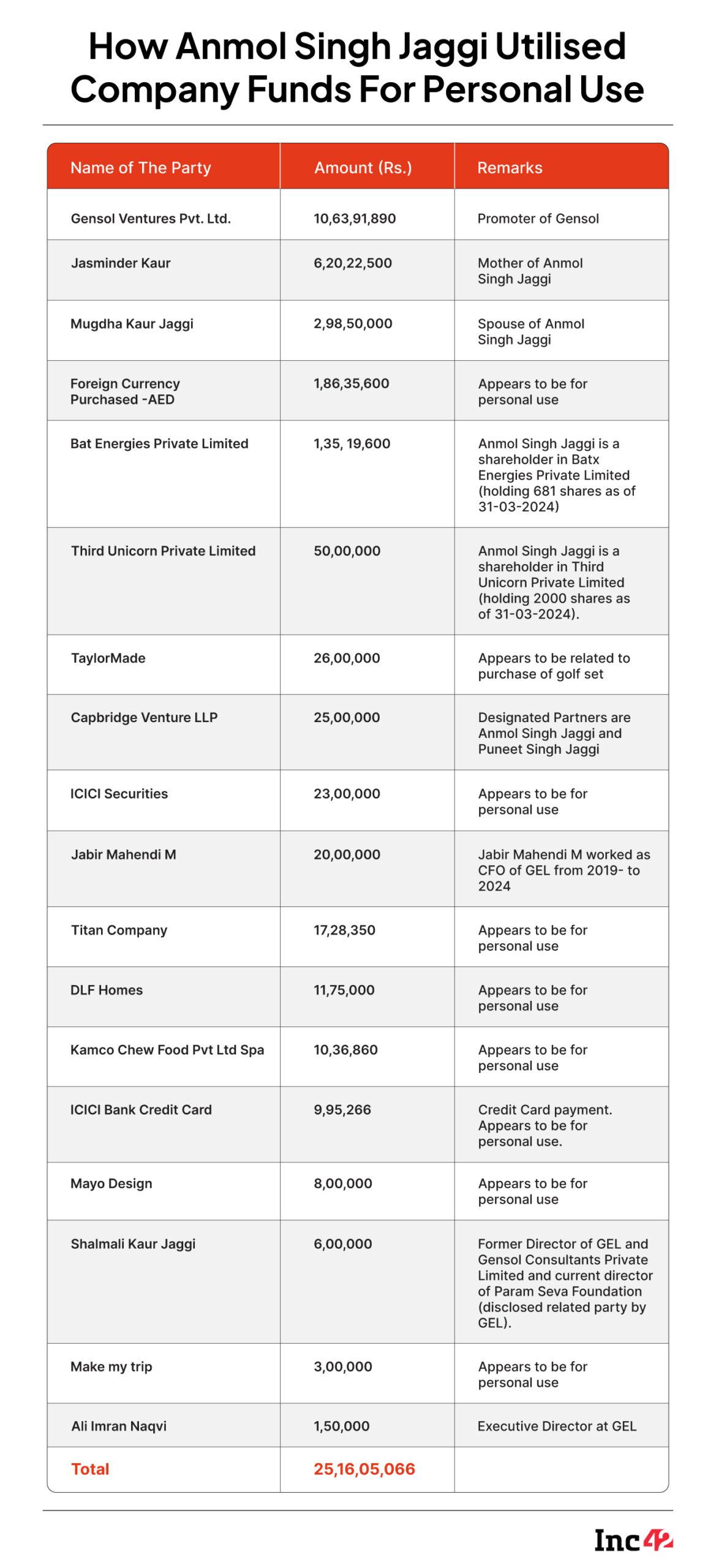

SEBI, in its detailed 29-page interim order, said that the brothers misutilised Gensol’s funds in a fraudulent manner and treated the capital as their piggybank. From using the company’s funds to buy a flat in DLF’s ‘The Camellias’ to investing in Ashneer Grover’s ‘Third Unicorn’, the order described in detail the modus operandi of the Jaggi brothers.

Here are the key details from the markets regulator’s findings:

Debt Default: The trouble for Gensol began , a related party, on its non-convertible debentures. When credit rating agencies (CRAs) sought details of the default, Gensol said that it was regular in its debt servicing and the default by BluSmart had no impact on the company.

Later, SEBI, which began investigating Gensol after receiving a complaint in June 2024 relating to manipulation of share price and diversion of funds, sought information from the Indian Renewable Energy Development Agency (IREDA) and Power Finance Corporation (PFC) regarding the debt servicing status of loans sanctioned by them to Gensol. The provided data showed that there were multiple instances of default by Gensol in servicing its loans.

While the company defaulted on INR 57.9 Cr debt from IREDA (inclusive of primary cash taken and interest payments), in case of PFC, the default was on loans worth INR 13.67 Cr.

Misleading Shareholders: The first instance of a loan default by Gensol took place on December 31, 2024.

As per SEBI’s norms, listed entities are required to make disclosure of any default on loans which continues beyond 30 days. However, Gensol failed to do so.

Besides, the EPC company informed the exchanges in January this year that it had received

pre-orders for 30,000 of its newly launched EVs, unveiled at the Bharat Mobility Global Expo 2025. However, SEBI found in its investigation that Gensol had only signed MoUs with 9 entities for 29,000 cars.

The MoUs were in the nature of an expression of willingness, with no reference to the price of the vehicle or delivery schedules. This way, the company made misleading disclosures to investors, the order said.

Bid To Manipulate Rating Agencies: When the CRAs sought term loan statements from Gensol following the default by BluSmart, the company provided the statements of all its lenders, except IREDA and PFC.

For PFC and IREDA, Gensol provided ‘Conduct Letters’ purportedly issued by them, which said that the company was regular in its debt servicing. However, the conduct letters turned out to be forged as both the lenders denied having issued any such letter.

Meanwhile, Gensol also continued to submit statements to the CRAs certifying there was no delay or default in servicing any loans even after there were multiple instances of loan defaults by it.

Fund Diversion: Gensol availed term loans to the tune of INR 977.75 Cr from IREDA and PFC between FY22 and FY24. Of this, INR 663.89 Cr of loan was taken to buy 6,400 EVs to be leased to the founders’ EV ride-hailing startup, BluSmart.

However, the company only purchased 4,704 vehicles as against the 6,400 EVs as committed while taking the loan. The cars were supplied to the company by a supplier named Go-Auto for INR 567.73 Cr.

Further, Gensol was slated to provide an additional equity (margin) contribution of 20% for the purchase, bringing the total expected deployment cost to INR 829.86 Cr

“Based on these figures, an amount of INR 262.13 Cr remains unaccounted, even though more than a year has passed since the company availed the last tranche of the above mentioned financing,” the SEBI order read.

These funds, the regulator said, were used for personal expenses of the promoters and the benefit of private promoter entities.

Stock Manipulation: Entities related to Gensol and its promoters indulged in trading in the company’s scrip in violation of regulations.

Stock Manipulation: Entities related to Gensol and its promoters indulged in trading in the company’s scrip in violation of regulations.

As per SEBI’s findings, Wellray, which is an entity related to the Jaggi brothers, bought INR 160.51 Cr worth of shares of Gensol and sold them for INR 178.44 Cr between April 2022 and December 2024. The capital for these trades was provided to Wellray by Gensol.

“It is prima facie observed that Gensol and its promoters/promoter related entities have funded Wellray for trading in the scrip of Gensol which is a violation of the restrictions contained in section 67 of the Companies Act, 2013. As is also apparent from the trading in the shares of Gensol by Wellray, the latter made handsome gains from the transactions,” the order read.

The Wellray Connection & More: Wellray Solar Industries Pvt Ltd was owned by Gensol Ventures Pvt Ltd and Puneet Singh Jaggi, both promoters of Gensol, till March 2020. Besides, the Jaggi brothers were also directors of Wellray till April 15, 2020.

Currently, ex-Gensol regulatory affairs manager Lalit Solanki holds a 99% stake in Wellray. Thus, Gensol and Wellray are connected through historical promoter positions and current key managerial associations.

Wellray was one of the recipients of funds from the money borrowed by Gensol from IREDA and PFC. An examination of the books of the two companies showed that a large part of Wellray’s revenue was booked through Gensol. While the entity’s revenue from Gensol was 55% of its total sales in FY22, it spiked to 91% in FY23.

Besides, Wellray also transferred INR 39.31 Cr to the brothers during this period. A majority of these funds were transferred by the brothers to related parties, family members, or used for personal purchases.

Meanwhile, amid the rise in Gensol’s stock price, its promoters gradually lowered their stakes in the company. Since listing in 2020, the promoter holding in Gensol nearly halved from 70.72% in FY20 to 35% as of March 31, 2025 (FY25).

The promoters also pledged over 75 Lakh shares to IREDA, as of April 11, while the BSE data suggests that more pledges have been invoked this month. This potentially would lead to the promoter shareholding in Gensol becoming even lower, “may be negligible”, if IREDA were to invoke the pledge created by the brothers, SEBI said.

Describing the state of the company, the regulator said, “… prima facie evidence of blatant violation of rules of corporate governance is writ large over the workings of the company. The diversion of funds of the company by promoter entities reflects a culture of weak internal control, where even ring-fenced borrowings from institutional creditors were rerouted at the total discretion of the promoters.”

However, it is the investors in the company who have suffered major losses. Shares of Gensol closed yesterday’s session at an all-time low of INR 123.65, down 87% from INR 920.10 on April 16 last year.

Meanwhile, the crisis at Gensol has also raised many questions about the future of BluSmart. The on the app yesterday.

Despite all these, Gensol continued to put up a brave face. In an exchange filing yesterday, the company said, “Gensol Engineering Limited reaffirms its commitment to full compliance with SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, and all other applicable regulations. We maintain a robust internal process to ensure that any event or information that has a material bearing on the company’s performance or stock price is disclosed timely and accurately to the stock exchanges. The company is dedicated to upholding the highest standards of corporate governance and transparency.”

The post appeared first on .

You may also like

'Margarita or just water?': Senator Chris van Hollen, El Salvador's president trade claims over meeting optics

Flesh-eating vulva infections on the rise in UK and can kill in hours

Coffee alternatives that will wake you up and help you lose weight

Real reason David Jason almost quit Only Fools and Horses

Awkward moment Princess Kate broke royal rule at Easter church service revealed