Emerging from the throes of the funding winter, Indian startups are on the mend. Funding numbers are improving, the growth-at-all-cost era appears over and investors are loosening their wallets as founders prioritise strong unit economics and sustainable business models.

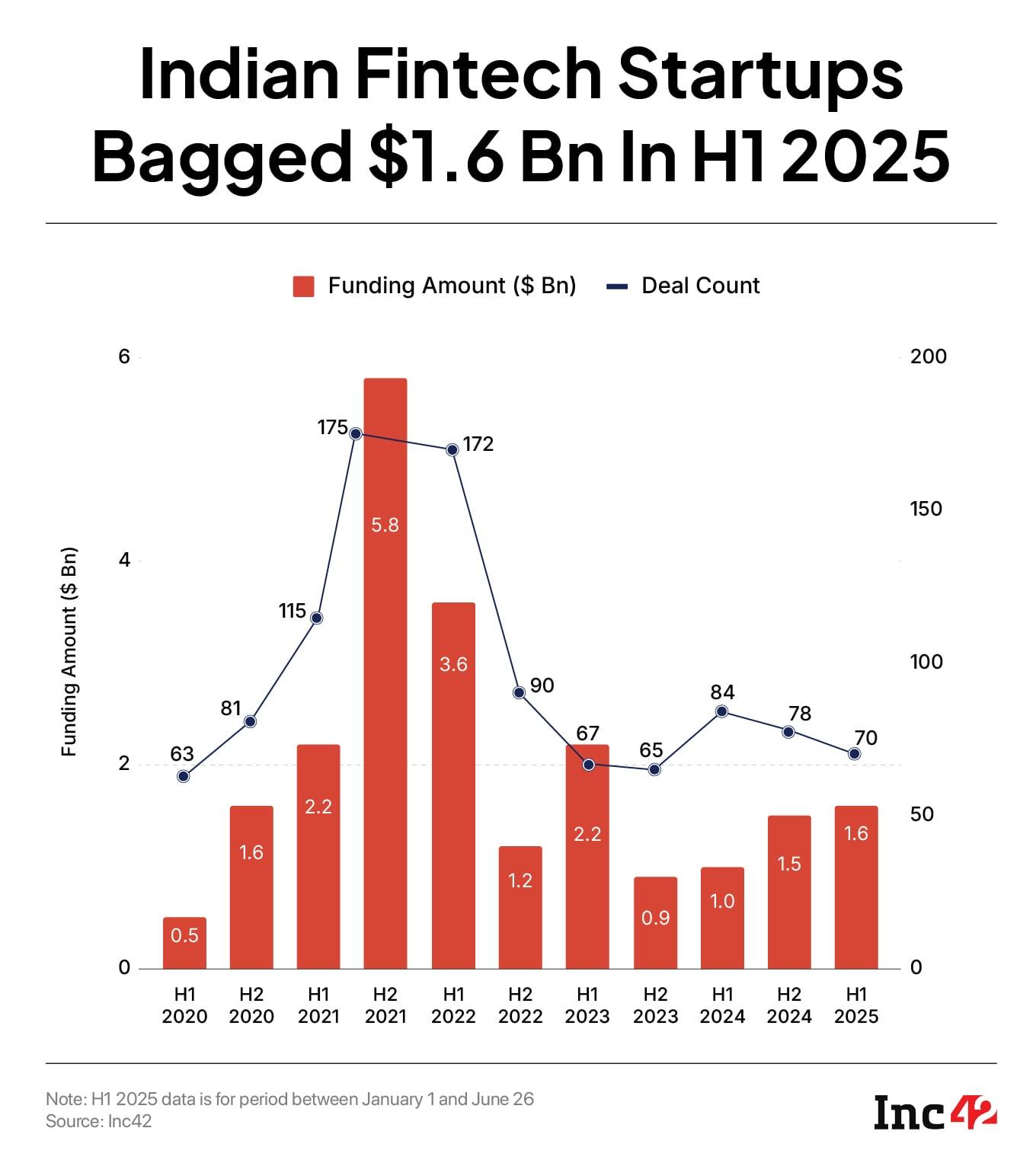

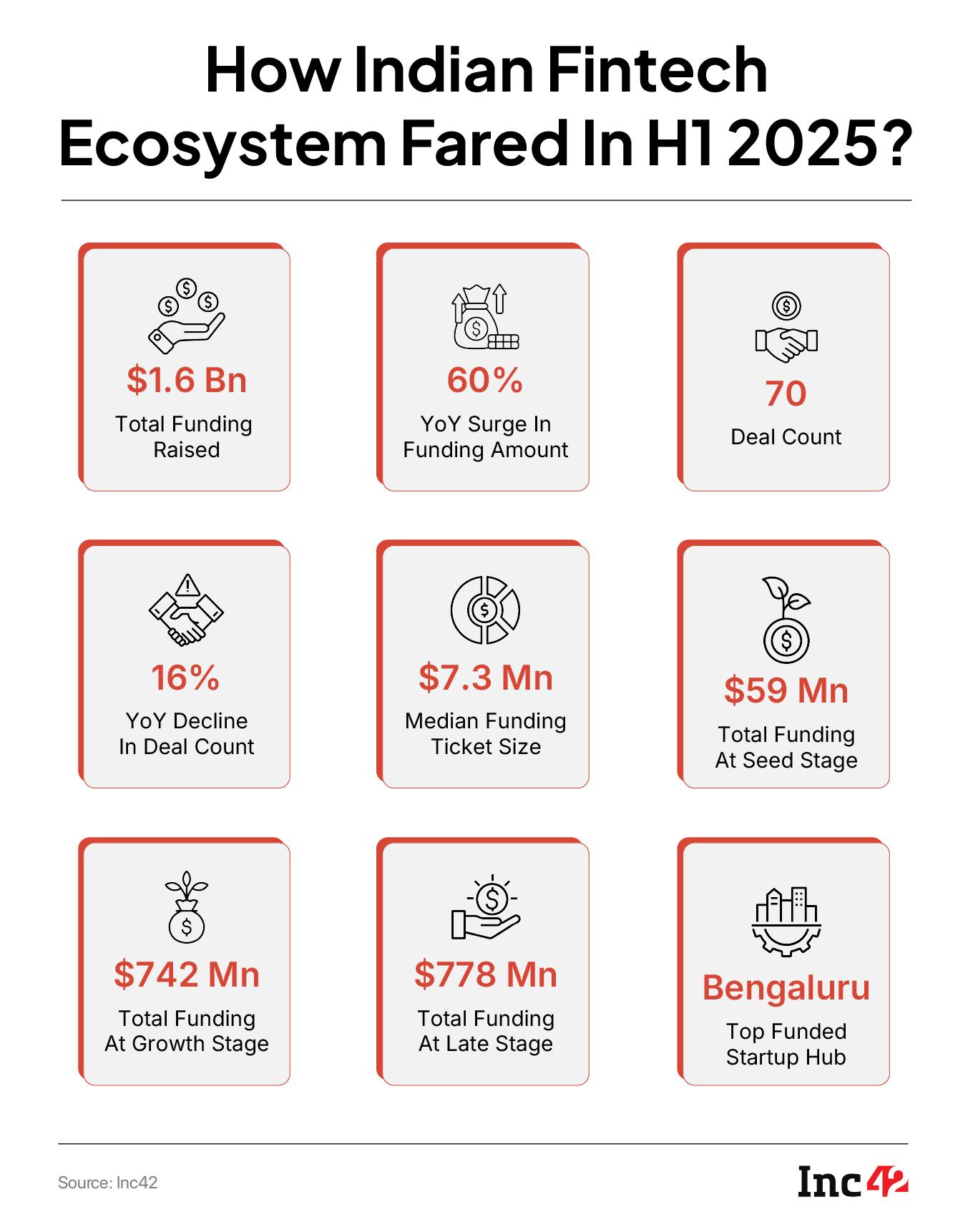

Leading the charge is the fintech sector, which continues to demonstrate its foundational strength and enduring appeal to investors. As per Inc42’s ‘State Of Indian Fintech Report H1 2025’, homegrown fintech startups raised more than $1.6 Bn in the first half (H1) of the ongoing calendar year, up 60% from $1 Bn raised in the year ago period.

Sequentially, too, funding rose 7% from $1.5 Bn in H2 2024.

The higher capital inflow into the sector came on the back of a big spurt in growth and late stage deals, signalling investors’ preference for proven business models over experimental ventures. Effectively, H1 2025 funding numbers were the second best since 2022, piped only by H1 2023 when fintech ventures raised $2.2 Bn.

Despite this, deal count declined more than 16% to 70 in H1 2025 from 84 in the year-ago period. The number of deals that materialised were also 10% lower than 78 recorded in H2 2024.

Meanwhile, the median investment ticket size for fintech startups surged more than 46% to $7.3 Mn during the period under review from a mere $5 Mn in H1 2024 on the back of higher inflow at growth and late stages. Sequentially, median ticket size declined 5% from $7.7 Mn in H2 2024.

Access Free ReportOverall, Indian new-age fintech startups raised more than $32 Bn between 2014 and H1 2025, reflecting continuing investor confidence in the sector.

Growth stage startups dominated the fintech show in H1 2025. The funding raised by them soared 225% to $742 Mn during the period under review from $228 Mn in H1 2024. Sequentially, it grew 2X from $370 Mn in H2 2024.

Growth stage deal count also improved to 32 in H1 2025 from 21 each in H1 2024 and H2 2024.

Meanwhile, late stage fintech startups raised $778 Mn in H1 2025, up 13% from $687 Mn in H1 2024. Sequentially, the funding zoomed more than 685% from $99 Mn in H2 2024. Startups at this stage continued to command premium valuations, particularly in banking and lending tech segments, with emerging regulatory clarity and AI integration driving sustainable competitive advantages.

Two mega deals materialised during the period, with Zolve raising a massive $251 Mn round and Groww bagging $202 Mn. The two startups alone contributed more than half of the total funding raised by late stage startups in H1 2025.

Late stage fintech deal count, however, declined to 19 in H1 2025 from 27 in the year-ago period and 26 in H2 2024.

However, seed stage funding crashed 21% to $59 Mn from $75 Mn in H1 2024. Deal count, too, tanked 38% to 31 versus 19 in the year-ago period.

Sequentially, early stage fintech funding declined nearly 33% from $88 Mn, while deal count withered 13% from 22 in H2 2024.

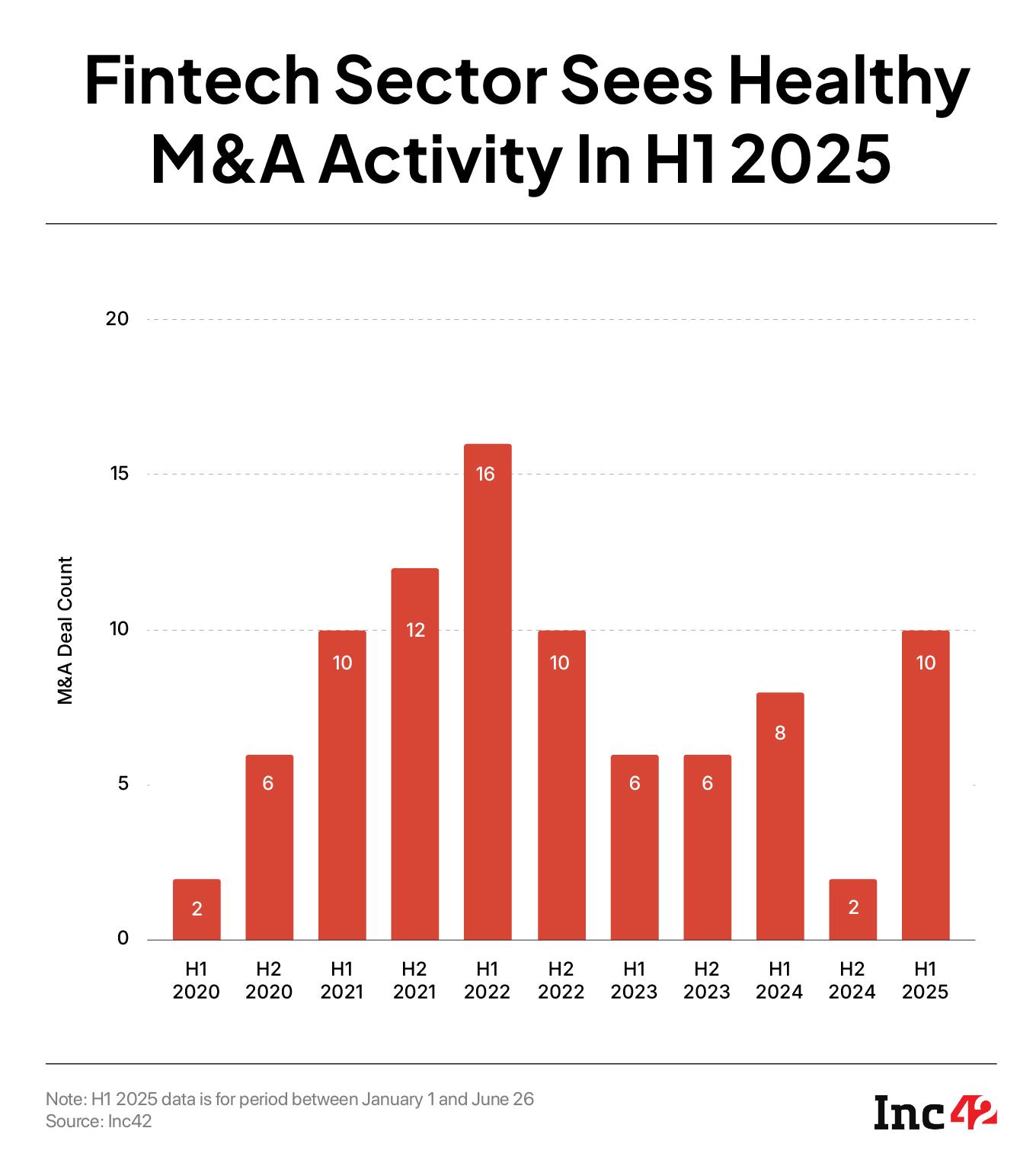

Buoyed by healthy capital inflow, the fintech sector witnessed healthy merger and acquisition (M&A) activity in H1 2025 – at par with that seen during H2 2022.

The M&A deal count jumped to 10 in H1 2025, up 25% YoY and 400% sequentially. Fullerton’s acquisition of troubled Lendingkart was the most talked about M&A deal in the first half of the ongoing calendar year.

That said, the growing percolation of AI is expected to further spur M&A activity in the fintech ecosystem as bigger players look to acquire competitors or complementary firms to strengthen their market position.

Bengaluru Remains The Fintech HubAmid all the humdrum, Bengaluru continues to be the fintech hub of the country. Of the total $32 Bn raised by homegrown fintech startups since 2014, ventures based out of the country’s startup capital raked in $10 Bn.

Playing a distant second fiddle is Delhi NCR, with fintech startups in the region raising $5.3 Bn in funding between 2014 and H1 2025. Mumbai is at the third spot with $3.4 Bn, while fintech startups in Chennai and Pune raised $1.3 Bn and $800 Mn, respectively, during this period.

In terms of deal count, Bengaluru topped the charts with 382 deals, followed by Delhi NCR and Mumbai with 254 and 232 deals, respectively.

Access Free ReportThe post Fintech Startup Funding Zooms 60% YoY To $1.6 Bn In H1 2025 appeared first on Inc42 Media.

You may also like

Amarnath Yatra 2025: Number of pilgrims likely to cross four lakh mark

Lai Ching-te's trip to Latin America: Typhoon Danas or Chinese interference - Why did Taiwanese president cancel tour?

Haryana School Closed: Schools in Haryana will remain closed till July 31, this is the reason..

J&K encounter: Security forces notice individuals trying to infiltrate into Indian side in Poonch; two fall down after being hit

Maareesan Movie Review: Fahadh Faasil and Vadivelu Shine in This Soul-Stirring Tamil Road Thriller